If you’re new to investing or trading in the stock market, Angel One (formerly Angel Broking) is one of the top platforms you can use. It allows you to buy and sell stocks, mutual funds, and other financial products with ease. In this blog, we’ll guide you step-by-step on how to open an Angel One broker account. Don’t worry, we’ll keep things simple so that even beginners and young learners can understand.

What is Angel One?

Angel One is a well-known stockbroker in India that helps people trade in the stock market. A stockbroker is like a bridge between you and the stock market. Through Angel One, you can invest in stocks, mutual funds, commodities, and much more.

Why Open an Angel One Account?

Opening an Angel One account has many benefits:

- User-Friendly: The platform is easy to use, even for beginners.

- Low Charges: They offer low brokerage fees, which means you don’t have to pay a lot to trade.

- Research and Tools: Angel One provides helpful tools and research reports that guide you in making the right investment decisions.

- Mobile App: You can trade using their mobile app, which means you can buy and sell stocks anytime, anywhere.

What Do You Need to Open an Account?

Before opening an Angel One account, make sure you have the following things ready:

PAN Card: This is an important document that every investor needs.

Aadhar Card: This will help you complete the e-KYC process.

Bank Account Details: You need a bank account that is linked to your PAN card.

Mobile Number: Your mobile number should be linked to your Aadhar card.

Signature: A scanned copy of your signature.

Passport Size Photo: A recent photo for identity verification.

Step-by-Step Process to Open an Angel One Account

Here is a simple, step-by-step guide to help you open your Angel One broker account:

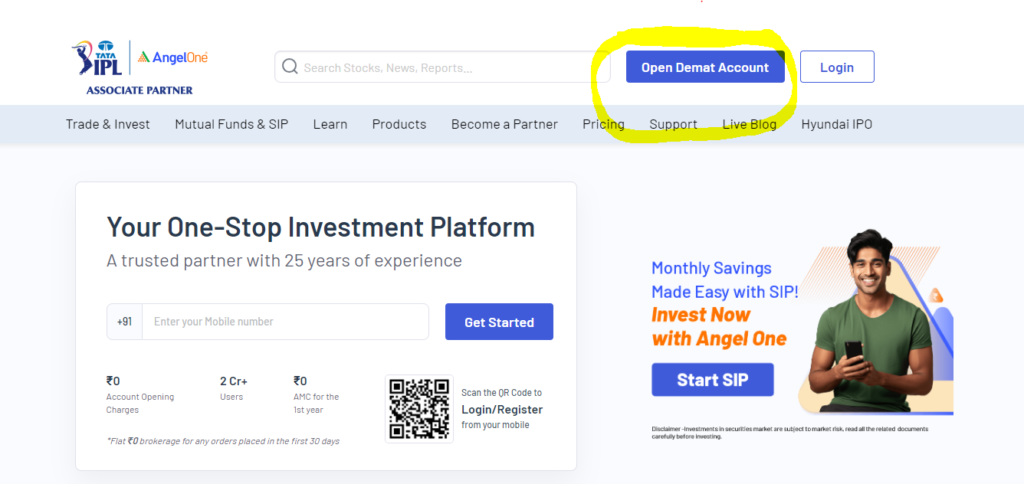

Step 1: Visit the Angel One Website or Download the App

First, visit the Angel One website or download their mobile app from Google Play Store or Apple App Store. Both options will lead you to the account opening process.

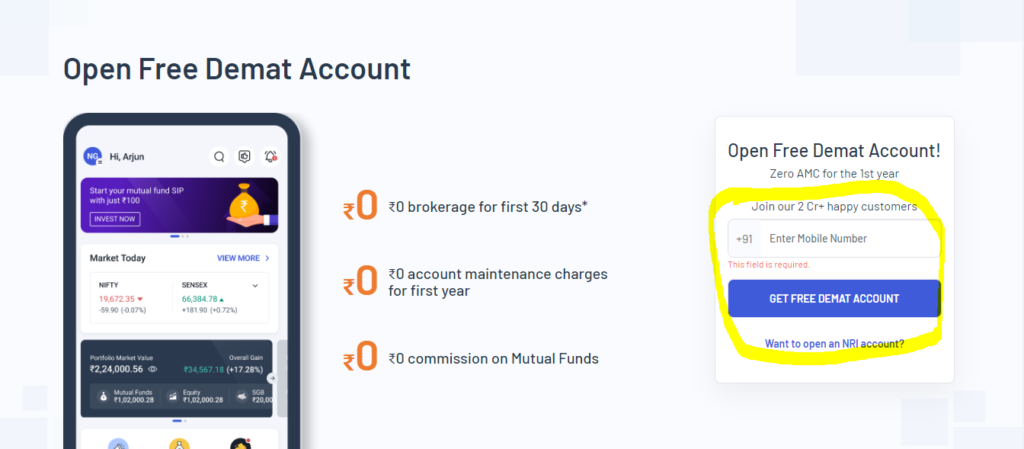

Step 2: Click on “Open an Account”

Once you’re on the website or app, you will see a button that says “Open an Account.” Click on it to start the registration process.

Step 3: Enter Your Basic Details

You will need to fill in some basic information like your full name, mobile number, and email address. After this, you will receive an OTP (One-Time Password) on your mobile for verification. Enter the OTP to proceed.

Step 4: Complete the KYC Process

KYC (Know Your Customer) is a process to verify your identity. Angel One allows you to do this online, which is called e-KYC. You will need to upload your PAN card, Aadhar card, and a few other details to complete this step. You can verify your Aadhar card using an OTP sent to your registered mobile number.

Step 5: Add Your Bank Details

Next, you will be asked to provide your bank account details. This is important because when you invest or trade, your money will come from or go into this bank account.

Step 6: Upload Your Signature and Photo

You will need to upload a scanned copy of your signature and a recent passport-size photo. This helps in verifying your identity.

Step 7: Choose Your Trading Options

Angel One allows you to choose what kind of account you want to open. You can select a Demat account if you want to hold stocks, or a Trading account if you want to actively trade in the stock market. You can also choose both.

Step 8: Review and Submit

Before submitting, review all the details to make sure they are correct. Once you are satisfied, click on the “Submit” button.

Step 9: Account Activation

After submitting your details, it usually takes a few hours to a couple of days for your account to get activated. Once it’s activated, you will receive a confirmation email with your login details.

How to Use Your Angel One Account

After your account is active, you can log in using the username and password sent to you. Here are some simple steps on how to start using your Angel One account:

- Log in: Use your email or phone number and password to log in.

- Deposit Money: You can add money to your account through net banking, UPI, or other payment methods.

- Start Trading: Now that your account is ready, you can start buying and selling stocks or other financial instruments.

- Use the Research Tools: Don’t forget to use Angel One’s research tools. They offer insights and recommendations to help you invest wisely.

Benefits of Opening an Angel One Account

Opening an Angel One account comes with several advantages that make it a popular choice for investors:

Comprehensive Trading Solutions: With Angel One, you can trade in a variety of segments, including stocks, commodities, and mutual funds, all from one account.

Advanced Tools and Reports: The platform offers valuable research reports, advanced charting tools, and market insights that help you make informed decisions.

Low-Cost Trading: Angel One’s competitive brokerage fees ensure that you don’t pay too much for executing trades.

Mobile Trading: The Angel One app is a powerful tool for investors who prefer trading on the go. You can monitor your investments, execute trades, and stay updated with market news anytime, anywhere.

Start Small: Begin with a small investment and increase it as you gain confidence and knowledge about the stock market.

Diversify Your Portfolio: Don’t put all your money in one stock or investment .Distribute your investments across various sectors to minimize risk.

Stay Informed: Keep yourself updated with market news and trendsThe more knowledge you have, the wiser your decisions will be.

Use Research Tools: Take advantage of Angel One’s research reports and tools to guide your investment choices.

Conclusion

Opening an Angel One broker account is a straightforward process that can be completed in a few simple steps. Whether you’re a beginner or an experienced trader, Angel One offers a comprehensive platform that meets all your trading and investment needs. From low brokerage fees to advanced research tools, Angel One provides everything you need to start your investment journey on the right foot.

Follow the steps outlined in this guide, and you’ll be well on your way to managing your investments effectively through Angel One. Happy trading!